Business Challenges that Initus Solves

NetSuite Collections Automation & Dunning Letters

Expedite cash flow and save your accounting team hours by automating rule-based dunning letters and ensuring collections communication hits the right customer entity every time.

Manual Overload

• Accounting teams spend days manually tracking due dates, calculating late fees, and drafting personalized collection emails for invoices.

• High human error rate in tracking and data entry.

• Repetitive work prevents focus on strategic finance tasks.

Delayed Cash Flow

• Failure to follow up promptly results in invoices frequently exceeding terms (Net 60/90), severely damaging working capital (DSO).

• Inconsistent follow-up schedules across the customer base.

• Slow payment cycles directly impact business liquidity.

Wrong Entity Errors

• Bills and reminders are often sent to the wrong subsidiary or address, requiring a payment clock reset and delaying receipt of funds.

• Costly delays when Net 90 terms are restarted due to a simple address error.

• Lack of visibility into who actually received the collection notice.

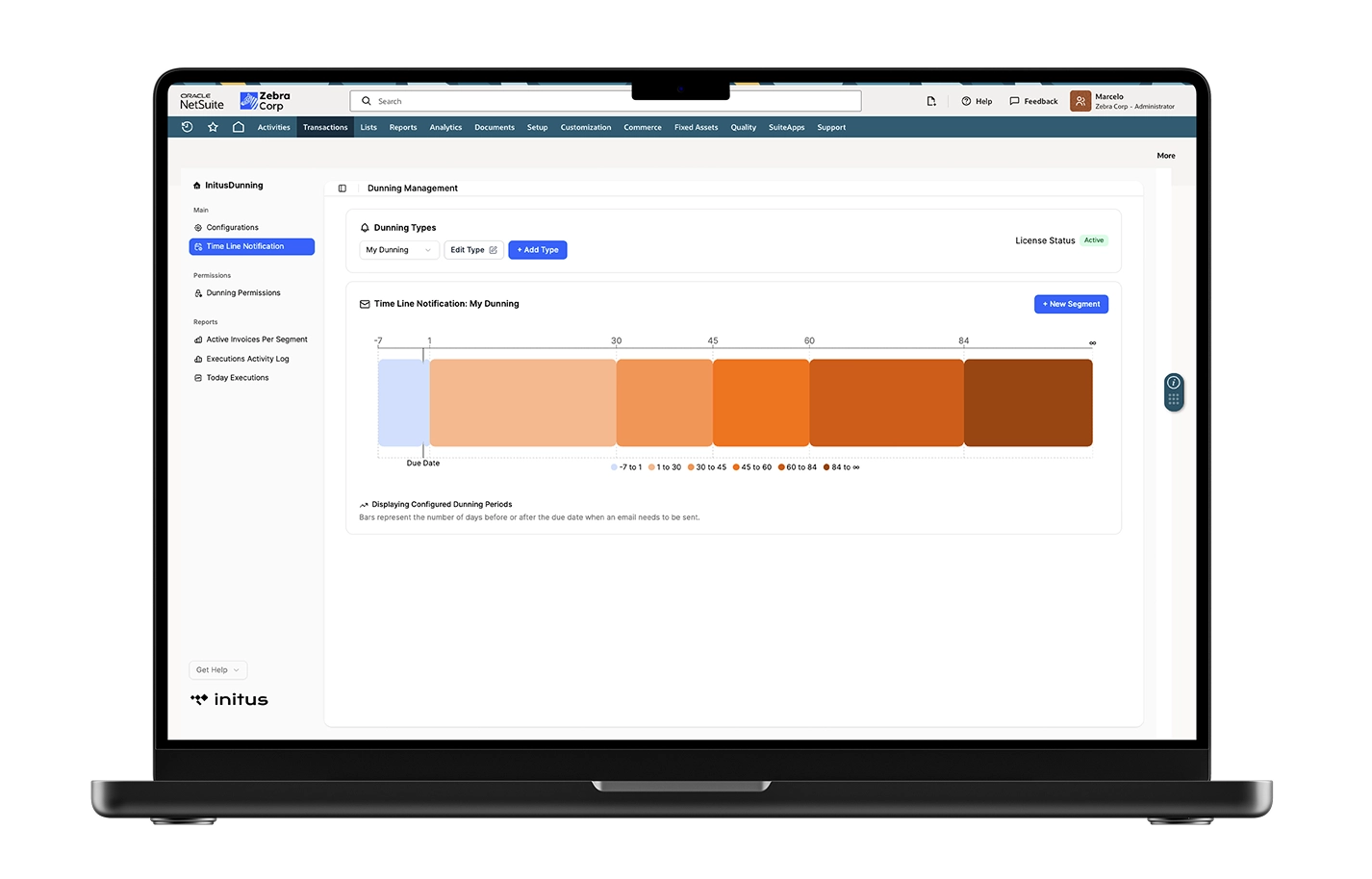

InitusDunning

Automated Dunning for NetSuite

Key Features & Automation

• Customer Entity Validation: Automatically cross-reference subsidiaries and contacts to ensure reminders are sent to the correct billing entity, eliminating address mistakes.

• Real-Time Balance Tracking: Provides consolidated, up-to-date customer balances and a logged history of all communication attempts directly in NetSuite.

The Result: Accelerated Cash Flow

• Expedited Cash Flow: Reduce average Days Sales Outstanding (DSO) by automatically executing reminders on time, every time, driving payments faster.

• Reduced Collection Errors: Eliminate the costly delays caused by manual errors like sending bills to the wrong subsidiary, saving weeks of waiting.

• Focus on Strategic Finance: Free up accounting staff from repetitive, low-value collections work to focus on analyzing financial performance and strategy.

Our Value

Our Collaborative Consult-and-Build Approach

Contact Us

Let’s define what’s next